Powering the Intelligence of Tomorrow - Always Clean, Always On

As the world grows smarter, its energy must grow cleaner. Avaada unites Solar, Wind, Hydro, and Storage into a seamless source of Round the Clock Clean Energy.

ABOUT US

Unlocking Nature's Potential for a Sustainable Tomorrow

Indian culture has always revered the ‘Panchtatvas’ which include wind, water, earth, fire, and the sky. We firmly believe in nature’s abundant potential and its paramount role in sustenance of life forms on the planet. Deriving our inspiration from forces of nature, Avaada’s business channelises these sources for powering human development.

SUSTAINABLE SOLUTIONS FOR GREENER FUTURE

Illuminating the planet using energy derived from sources that naturally replenish over time

Embracing United Nations Sustainable Development Goals

01

No Poverty

End poverty in all its forms everywhere.

02

Zero Hunger

End hunger, achieve food security and improved nutrition and promote sustainable agriculture.

03

Good Health & Well Being

Ensure healthy lives and promote well-being for all at all ages.

04

Quality Education

Ensure inclusive and equitable quality education and promote lifelong learning opportunities for all.

05

Gender Equality

Achieve gender equality and empower all women and girls.

06

Clean Water & Sanitation

Ensure availability and sustainable management of water and sanitation for all.

07

Affordable & Clean Energy

Ensure access to affordable, reliable, sustainable and modern energy for all.

08

Decent Work & Economic Growth

Promote sustained, inclusive and sustainable economic growth, full and productive employment and decent work for all.

09

Industry, Innovation & Infrastructure

Build resilient infrastructure, promote inclusive and sustainable industrialisation and foster innovation.

10

Reduced Inequalitities

Reduce inequality within and among countries.

11

Sustainable Cities & Communities

Make cities and human settlements inclusive, safe, resilient and sustainable.

12

Responsible Consumption & Production

Ensure sustainable consumption and production patterns.

13

Climate Action

Take urgent action to combat climate change and its impacts.

14

Life Below Water

15

Life on Land

16

Peace, Justice and Strong Institutions

17

Partnership for the Goals

Connecting Together for a Brighter Tomorrow

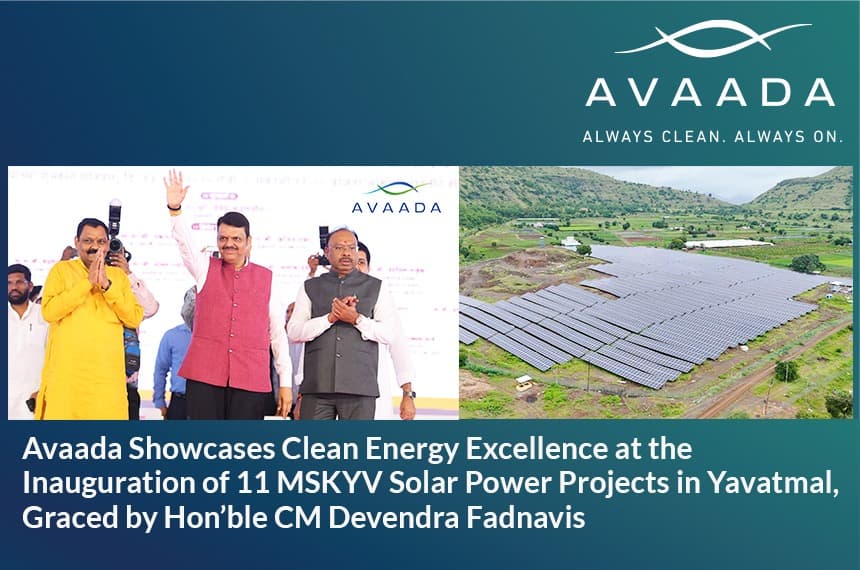

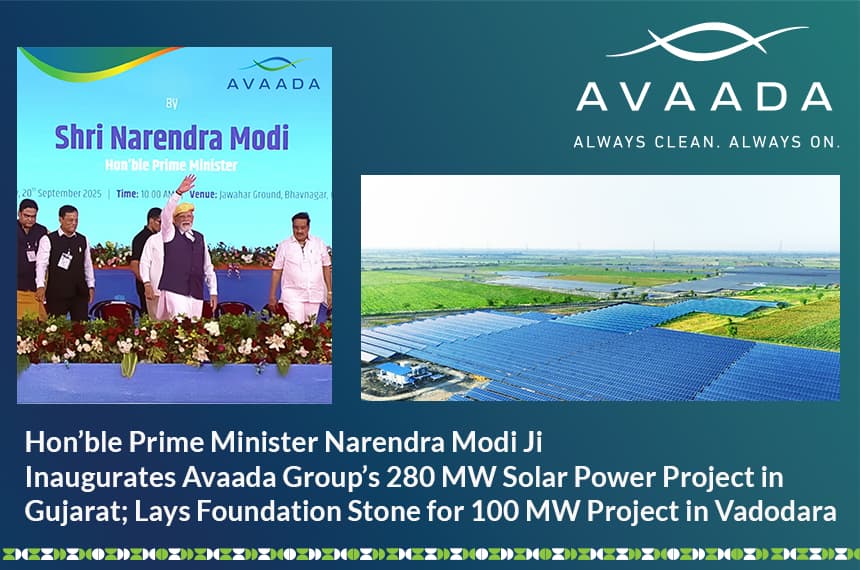

Explore Our Events

PARTNER WITH US

Partnering for Sustainable Solutions

Haryana

50 MWp Commissioned

Rajasthan

2116 MWp Commissioned

1960 MWp Under Implementation

Bihar

71.75 MWp Commissioned

Uttar Pradesh

169 MWp Commissioned

Gujarat

820 MWp Commissioned

1370 MWp Under Implementation

Madhya Pradesh

279 MWp Commissioned

Maharashtra

1013 MWp Commissioned

1426 MWp Under Implementation

Karnataka

792.56 MWp Commissioned

Tamil Nadu

65 MWp Commissioned

Our Projects

Powering Progress, Energizing India

Rajasthan

2116 MWp Commissioned

1960 MWp Under Implementation

Maharashtra

1013 MWp Commissioned

1464 MWp Under Implementation

Gujarat

1509 MWp Commissioned

1372 MWp Under Implementation

Karnataka

792.56 MWp Commissioned

Bihar

71.75 MWp Commissioned

Uttar Pradesh

169 MWp Commissioned

Haryana

50 MWp Commissioned

Tamil Nadu

65 MWp Commissioned

Madhya Pradesh

279 MWp Commissioned

JOIN OUR TEAM

Life at Avaada

Avaada thrives on “Promise” and “Values” uniting for sustainable infrastructure to nurture Mother Earth

Global Energy Transition Ambition

Join Avaada in the collective pursuit of a global energy transition shaping the future of humanity.

Work-Life Harmony Initiative

At Avaada, we prioritize & safeguard the work / life balance of our employees, fostering a harmonious & fulfilling professional journey.

Avaada: Your Second Home

Experience a workplace where your hard work and dedication are valued. With the support of our managers and HR team, Avaada strives to make your professional environment a second home.